Some Ideas on Mortgage Broker You Need To Know

Wiki Article

The Buzz on Mortgage Broker

Table of ContentsThe smart Trick of Mortgage Broker That Nobody is DiscussingThe 9-Second Trick For Mortgage BrokerA Biased View of Mortgage BrokerA Biased View of Mortgage BrokerThe Ultimate Guide To Mortgage BrokerThe Greatest Guide To Mortgage Broker

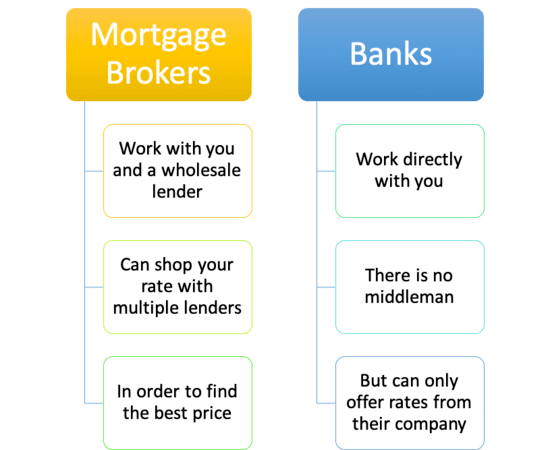

They can undergo all their lending institution partner's programs to locate the ideal fit for you, as well as hopefully the very best pricing as well. For instance, they may locate that Bank A supplies the most affordable rate, Bank B supplies the most affordable closing prices, and Financial institution C has the very best feasible mix of rates and charges.

And who desires to get a mortgage a lot more than as soon as? The number of banks/lenders a home loan broker has access to will vary, as brokers need to be accepted to function with each independently. A person that has actually remained in business a lengthy time could have developed a multitude of wholesale companions to choose from.

9 Simple Techniques For Mortgage Broker

They might likewise suggest that you limit your finance total up to an adhering amount so it abides by the guidelines of Fannie Mae and also Freddie Mac. Or they may recommend that you break your car loan into an initial as well as bank loan to prevent mortgage insurance policy and/or obtain a better combined rate - mortgage broker.For instance, if you have bad credit or are an investor, brokers may have wholesale home loan companions that focus on home loan simply for you (mortgage broker). But they may not deal with the retail level, so you 'd never understand about them without your broker liaison. A retail financial institution might simply give you generic finance selections based upon the loan application you submit, without any type of additional understanding in regards to structuring the bargain to your benefit.

The Greatest Guide To Mortgage Broker

If you recognize you're looking for a particular type of loan, looking for out one of these specialized brokers might lead to a better end result. They may additionally have partners that originate big mortgages, thinking your funding amount goes beyond the conforming loan restriction. When all the details are resolved, the broker will certainly submit the loan to a lending institution they work with to get approval.What they charge can vary significantly, so make sure you do your homework before agreeing to function with a home mortgage broker. Home Mortgage Brokers Were Condemned for the Real Estate Dilemma, Brokers obtained a whole lot of flak for the recent housing dilemma, Specifically since brokered house lendings displayed greater default prices, Family member to house fundings came from through the retail financial network, However ultimately they just re-selled what the banks were offering themselves, Home mortgage brokers were mainly criticized for the mortgage situation since they originated financings on part of various financial institutions as well as weren't paid based on funding performance.

Per AIME, brokers have actually historically not been offered the recognition they deserve for being professionals in their field. Home Mortgage Broker FAQLike all other financing begetters, brokers charge origination fees for their solutions, and also their charges might vary extensively. It sets you back money to run a home loan brokerage, though they might run leaner than a big financial institution, passing the cost savings onto you.

Read Full Article

Mortgage Broker for Beginners

If they aren't charging you anything directly, they're just making money a broker payment by the lender, indicating you'll end up with a greater rate of interest to compensate. Make certain to check out all choices to get the most effective mix of price and also costs. Not necessarily; as discussed home loan brokers can use affordable prices that fulfill or defeat those of retail financial institutions, so they need to be thought about together with financial institutions when looking for financing.In addition, brokers need to typically complete pre-license education and learning and also some needs to secure a bond or satisfy certain total assets needs. Yes, home mortgage brokers are managed on both the government as well as state level, and should abide by a a great deal of regulations to conduct service. Furthermore, customers are able to search for broker documents via the NMLS to guarantee they are licensed to conduct service in their state, as well as to see if any actions have actually been taken versus them in the past.

And regardless of the ups and downs that feature property, they will certainly probably continue to play an energetic duty in the home loan market because they supply a distinct solution that big financial institutions and credit rating unions can not copy. While their numbers might vary from time to time, their solutions should constantly be available in one method or another.

Little Known Facts About Mortgage Broker.

Making use of a mortgage broker such as not just makes audio monetary sense, yet will certainly supply you with all types of essential aid. So, you're searching for mortgage deals to help you buy a building, yet with many home mortgage firms and also about his home loan loan providers available, it can be hard to know where to begin.Besides, there are numerous expenses included with buying and relocating house or remortgaging. Yet attempting to do without a mortgage broker would be a blunder as home mortgage broker advantages are clear. Using a home mortgage broker such as Car loan. co.uk not just makes audio monetary feeling, however will certainly provide you with all kind of vital aid.

Save you cash A home mortgage broker will comb the offered home mortgages for you and also take a look at the very best bargains. This isn't just a case of trying to find the lowest home mortgage rates today, or the least expensive tracker home mortgage or most affordable taken care of price home mortgage. A competent home loan broker has the ability check my site to look past the home mortgage interest rates to consider all the other charges that will apply.

The Main Principles Of Mortgage Broker

4. Provide you expert monetary guidance Mortgage brokers have actually to be qualified to help you locate a mortgage and provide you monetary advice. They are likewise have a task of care to offer you the most effective recommendations they can, instead of simply push the option that will certainly provide the most commission.Look after the application documents The world of home mortgage funding is complete of jargon and also laborious documentation, yet the specialists at Loan. co.uk will certainly deal with all that tough work for you. They'll prefill your mortgage application for you so your brand-new mortgage can go as efficiently as possible.

Report this wiki page